Table of Contents

ToggleWhat are Alternative Investments?

An alternative investment is a financial asset that does not fall into the general definition of conventional investment categories. In India, most investors have become savvy about mutual funds and the stock market in the last 10 years. However, there are assets that go beyond these categories and have the ability to provide good returns

Why should you invest in Alternative Assets?

When an investor develops their portfolio they choose investments based on efficiency, aiming to earn a maximum return for minimum risk. Alternative assets are often attractive because of the high returns they can generate, and the opportunity they provide to diversify an investment portfolio away from traditional investments, which consequently reduces overall portfolio risk. The major reason people invest in alternatives are:

-

- Lower Volatility

-

- Enhanced Returns

-

- Broad Diversification

-

- Regular Cashflows

To read more about the benefits of Alternative assets in the portfolio – Benefit of Alternative Investment

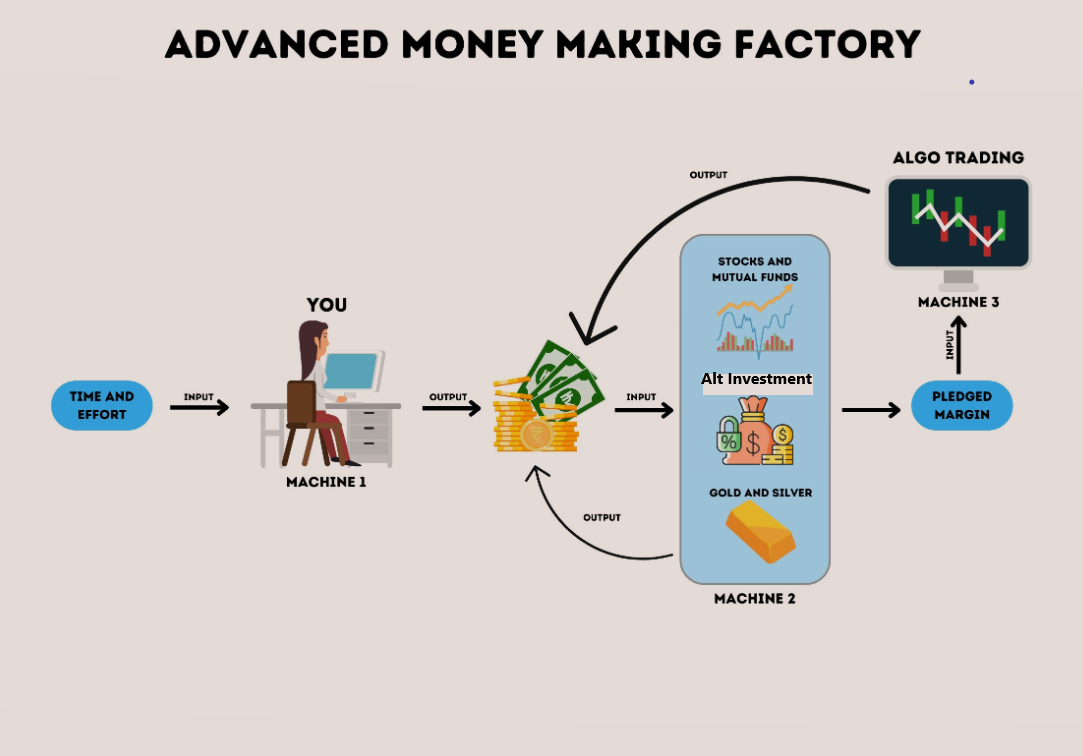

How to create an Alternative Investment Portfolio?

Most people invest randomly in deals across multiple platforms based on limited knowledge. Before making any investment, it is paramount that the investor focuses on the below aspects

-

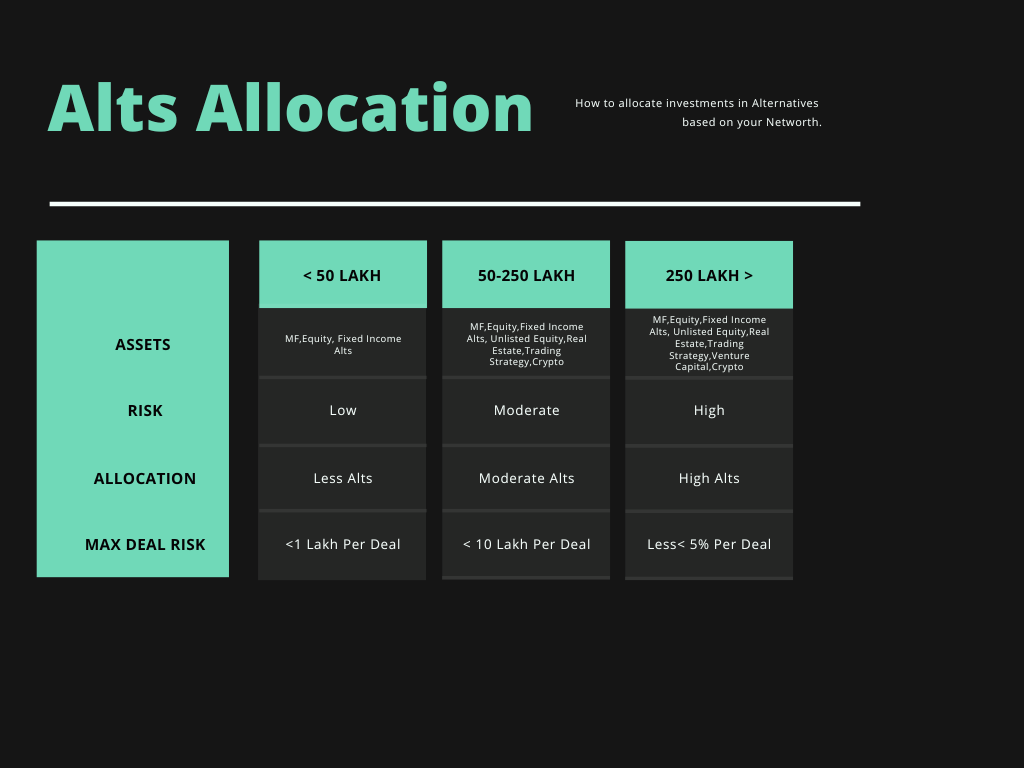

- Networth and Tax– A strong portfolio is a combination of high-quality equity and debt funds that provide the basis for tax-optimized long-turn returns. However, a large allocation to Equity may produce high volatility. Similarly, shorter-dated fixed-income products like FD and liquid funds generate poor tax-adjusted returns. However, the allocation to a platform should be based on Networth. Someone with a large networth may not want high exposure to equity and can choose a combination of alternative investments. It is also important that post-tax returns be compared with instruments of similar maturity with lower risk.

Cashflow Requirement – Investor cant take out money from long-term equity holding. Many investors’ monthly cash flow to meet expenses or for their monthly Mutual funds’ SIP. Alternatives can help you to get a stable cash flow. Products like invoice discounting, Leasing, etc can give monthly cash flow and help to maintain liquidity.

Example – If an Individual has a 1 crore portfolio and has 50/50 Debt- Equity preference, he can put a part of his debt investment in 3 years plus an instrument like Bharat bond ETF, etc which can give a 7% post-tax yield. For short-term investment instead of doing FD or debt funds he can choose alternatives that give periodic cashflow or have short maturity and yield 10%+

b) Risk appetite– People should be cognizant of the risk in each product before making any significant investments. Some products like Crypto, Venture capital, and Trading Strategies have higher returns but also come with higher volatility. Hence exposure should be done based on the investor’s risk profile.

Example- Cryptocurrency can give very high returns but they go through cycles where investors can have a drawdown up to 50-70% of their portfolio hence allocation should be done based on risk appetite

c) Yield-based vs Capital Gain– Split between long-term capital gain assets vs short-term lending assets have to be decided. A good allocation helps to grow the long-term corpus while maintaining a healthy level of portfolio liquidity for income and financial security.

What are the best Alternative Investment Platforms to get started?

Type of Platforms

-

- Income Generating Platform – Platforms that have a fixed yield and are primarily used to generate income or park money

-

- Unlisted Equity and Venture Investing-Platforms which provide access to early-stage/late-stage companies before they are listed on an exchange

-

- Managed Trading Platforms- Trading strategies managed by top traders which can generate a return on your available margin.

-

- Real Estate Platform– Platforms to invest in commercial real Estate/ Land to generate income or capital appreciation

-

- International investment – Platform to invest in foreign equity and alternative assets

Top Income-Generating Platforms

| Platform | Type of Deals | Min Investment | Average Returns | Detailed Review |

|---|---|---|---|---|

| Jiraaf | Invoice Discounting, Bonds, Leasing ,Venture Debt | INR 100,000 | 12-18% | Jiraaf Review |

| Grip Invest | Leasing, Corporate Bonds, Real Estate, Startup Equity | INR 20,000 | 10-21% | |

| Klubworks | Revenue Based Finance | INR 250,000 | 15-25% | |

| Altifi | High Yield Bonds ,MLD, Commercial Paper | INR 10,000 | 10-14% | |

| TradeCred | Invoice Discounting | INR 50,000 | 10-12% | |

| Lendbox | Settlement Finance, Liquid Fund Alternative | INR 50,000 | 10-12% |

Top Unlisted Equity Platform

| Platform | Type of Deals | Min Investment | Average Returns | Detailed Review |

|---|---|---|---|---|

| Unlistedzone | Unlisted Shares India | INR 10,000 | N.A. | Unlisted Zone Review |

Top Independent Traders/Strategies to Invest

| Platform | Type of Deals | Min Investment | Average Returns | Detailed Review |

|---|---|---|---|---|

| Tradetron | Selected Automated strategies | INR 200,000 | 10-30% | Stockal |

Real Estate Investing

| Platform | Type of Deals | Min Investment | Average Returns | Detailed Review |

|---|---|---|---|---|

| Aasthy | Land and Flats | INR 10,000 | 10-15% | Stockal |

| Myre Capital | Commercial Real Estate | INR 15 Lakh | 8-13% | Stockal |

International Stocks

| Platform | Type of Deals | Min Investment | Average Returns | Detailed Review |

|---|---|---|---|---|

| Stockal | International Shares | INR 200,000 | 10-15% | Stockal Review |

Saving and Investment template

It’s a challenge to monitor multiple investments and platforms. To make the process seamless we have created an investment and saving template which can help to track your savings and investment portfolio. Download the Template by subscribing and dropping us a mail here – Info@Yieldkart.com

Monthly Review and Getting started Call

The biggest challenge people face with alternative investment are

-

- The initial learning curve to choose the best platform suited for the risk profile.

-

- Benchmark your portfolio against other investors to understand which deals and platforms are performing well. You can Fastrack your process by using our database

To get a 10 mins call or to benchmark your portfolio check – Portfolio Analysis