What is Youholder? Do you remember when you stuffed coins and cash in your piggy banks? Well, today, you do not do it with physical cash because you have access to many digital wallets and investment platforms where you save money and earn from it in the form of interest or profits.

In this blog, we will understand YouHodler, a crypto lending and borrowing platform.

What is YouHodler?

Youholder Bonus

YouHodler is a centralized crypto lending and borrowing platform. That means whether you are a lender or borrower, you can get loans from this platform or be a lender and earn interest in exchange.

YouHodler also provides an exchange service to swap between fiat and crypto or two kinds of crypto. However, it is different from other available platforms because it has MultiHODL and Turbocharge products and helps its users aggressively boost their returns.

Exchanging Between Fiat and Crypto

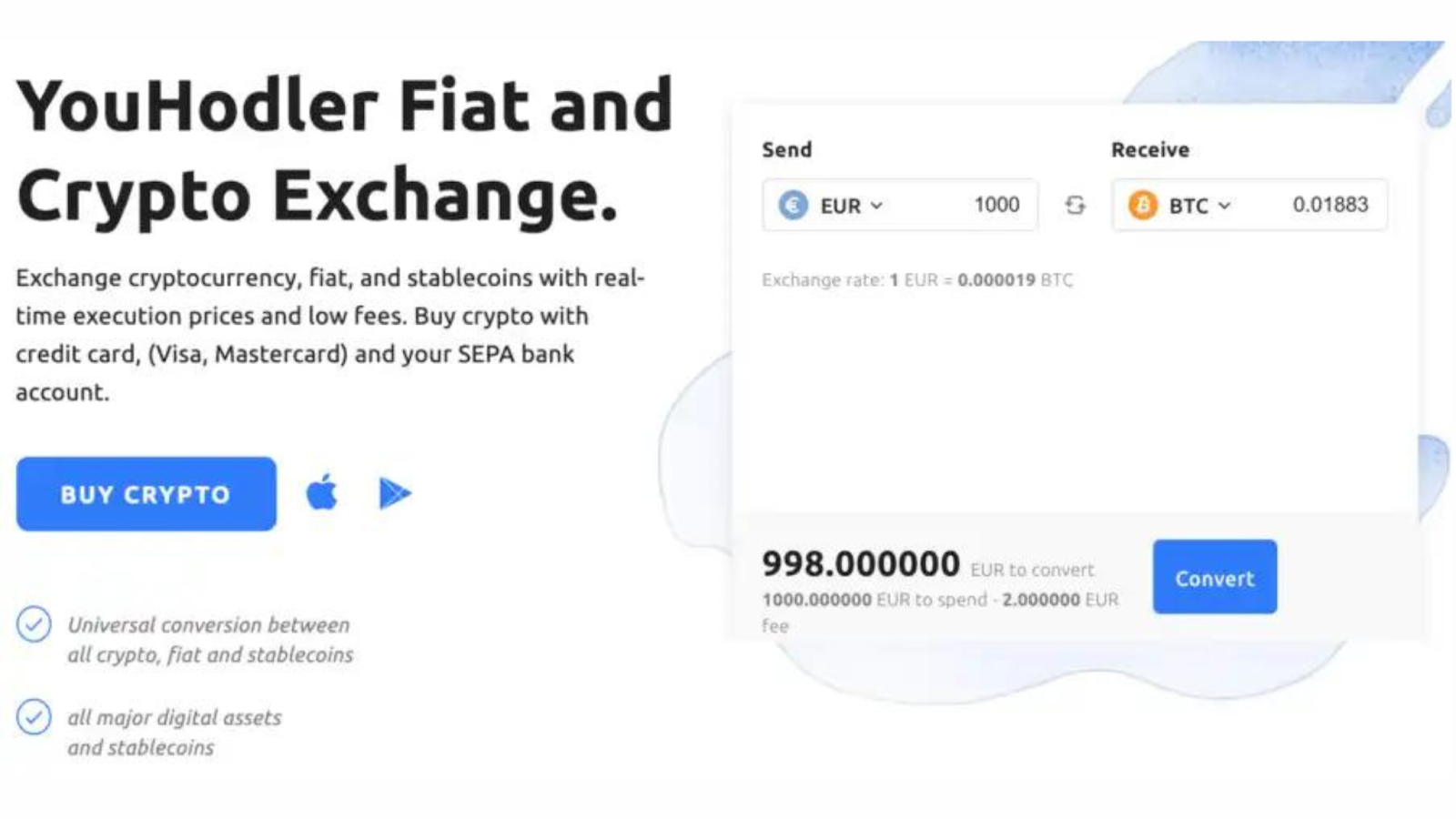

Youhodler is an excellent platform for those who have just put their hands in crypto as it offers an exchange service for swaps between fiat and crypto, which means you can deposit cash in exchange for crypto or exchange your crypto for cash.

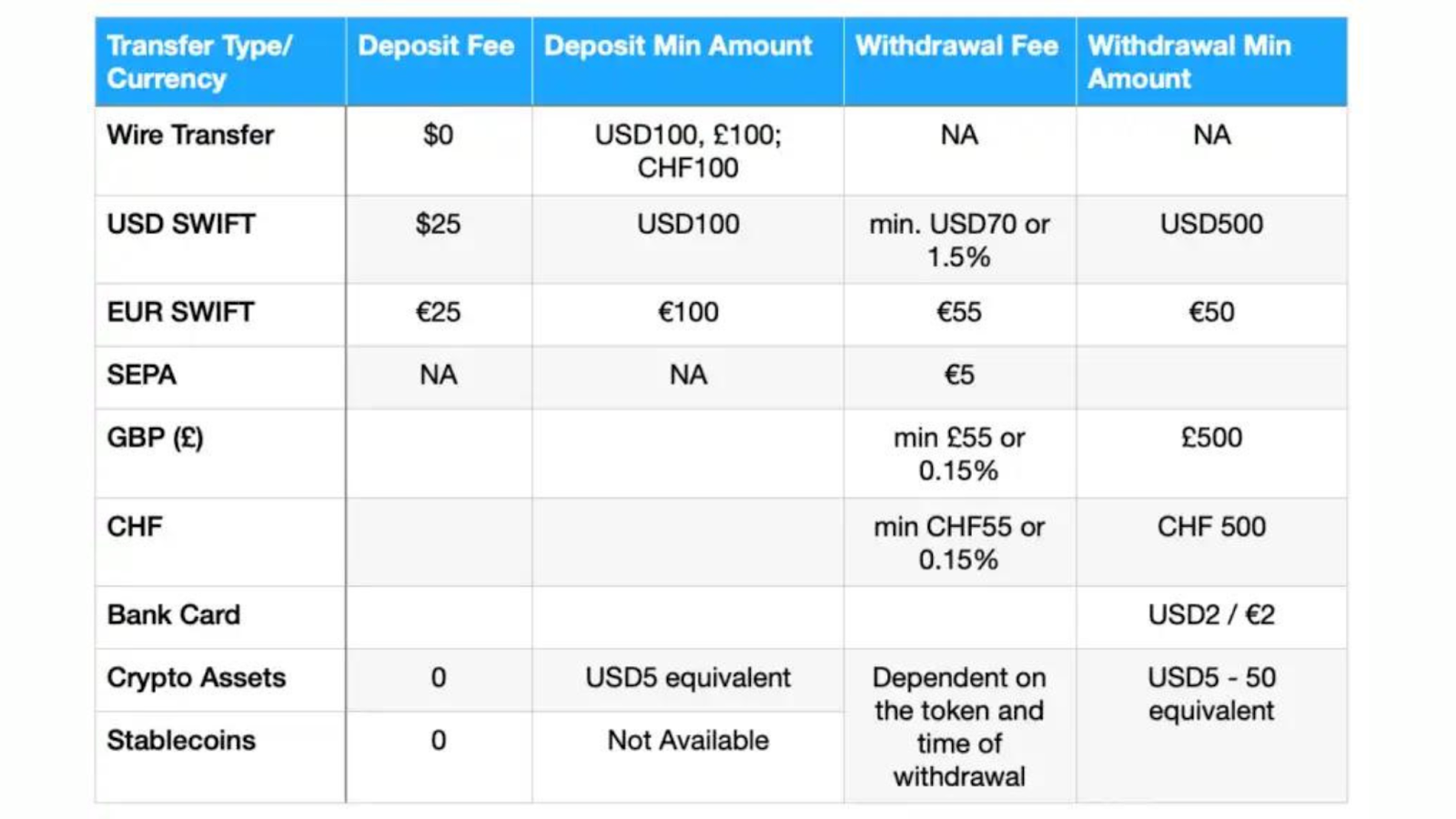

Youhodler Fees for Exchanging Crypto

Now, you must be wondering what rates you get for the exchange. The rate depends on the demand and supply factors and the rate of the specific cryptocurrencies. Also, deposit and withdrawal fees are applicable. Here is a chart with all the prices mentioned.

Minimum Deposit on Youhodler

The minimum deposit on the platform starts at $5. You just need to complete your KYC process on their official website. You must upload your personal information, including proof of your identity. This step is crucial to avoid criminal activity and is regulated by the Anti Money Laundering (AML).

After verification, it is also crucial to secure the funds on the platform, including insurance and the people involved in running the operations.

Insurance By Ledger Vault

Youhodler’s homepage promotes the use of Ledger Vault to protect investors’ money and provides up to $150 of pooled crime insurance.

Pooled crime insurance is an insurance product offered by Ledger Vault. The platform depends on one other lending platform to provide some safety. This idea boosts confidence in investors’ minds as the number of companies looking for insurance claims simultaneously would be less in any significant event.

YouHodler History

The platform was started in 2017. YouHodler was run by Naumard Ltd. in Cyprus and YouHodler SA in Switzerland.

YouHodler Founders

Ilya Volkov is the CEO, Renat Gafarov is the CTO, and Alex Vinny is the Head of the company’s Product.

Ilya Volkov: CEO and Founder

Ilya had a Philosophy degree from Moscow before he entered the Fintech world, and he has work experience of over ten years in Commercial Finance and ten years of experience in online trading.

In an interview, he also shared his entrepreneurial journey of starting YouHodler inspired by the LUMIAMI approach and Design Thinking. He aims to offer different services on the platform that connect banking, trading, and crypto in a single place.

Renat Gafarov: CTO

Earlier, Renat was a front-end developer and worked with multiple companies before he joined YouHodler, and for the last four years, he has been working at YouHodler.

Alex Vinny: Head of Product

Alex studied at Altai State University in Russia. He knows Ilya from the Forex Club, where he worked as a UI/ UX Designer and became a product designer before joining YouHodler as a UI/UX Designer.

All the prominent persons of YouHodler hold significant experience and have the proper knowledge of what they are doing. However, from their experience, no one comes from a management background, which can be a risk but can be covered as the company scales.

How YouHodler Works for Lenders?

Youholder BonusThe platform claims that the lenders can earn up to 12.3% interest annually for crypto assets and fiat, respectively. YouHodler also provides an earnings calculator to check how much you get for your crypto tokens. Here is the list:

- MKR, COMP, REP 2.5%

- HT, BNB, BAT, BNT, DOGE, OMG 3.0%

- XLM, XRP, YFL, ZRX 4.5%

- BTC 4.8%

- EOS 5.0%

- LTC, BCH, DASH, ETH 5.5%

- SNX, ADA, AAVE 6.0%

- LINK 6.2%

- UNI, SUSHI, TRX 7.0%

- PAXG 8.2%

- DOT 9.0%

- BUSD 10%

- EURS, USDP 12%

- USDT 12.3%

How Does YouHodler Work for a Borrower?

Youholder BonusThe top 20 coins are used as a security, as mentioned on their loan page, and it secures a loan of up to 90% of the collateral value. This is also known as the Loan to Value ratio (LTV). For example, 90% LTV means you can get $900 from the collateral worth $1,000.

The platform accepts the top 14 cryptocurrencies as collateral without crypto deposits or withdrawal fees.

You are guaranteed to get the loan if you have the mentioned collateral because all the crypto platforms use intelligent contracts. However, the demerit is that instant liquidation might be an issue if the collateral amount is worth less than the loan amount because the crypto market is always volatile.

Just like the stop loss feature on stock trading, there is one similar feature here, also known as the Price Down Limit (PDL). In this feature, once 2/3 of the PDL is reached, you will get a notification from the YouHodler team asking for more collateral, and if you wish, you can add more collateral to your loan.

Moreover, you can also do one of the following things:

- You can close the loan using the Close Now feature. This feature lets you close the loan and stop repaying with the collateral.

- You can take profits using its Set Close Price feature whenever you want to book profit. Once it reaches a specific price, a part of the collateral is sold to repay the loan, and the rest of the amount is deposited into the account.

- You can also use its Reopen feature, which allows you to extend the loan without repaying it by activating this feature. However, fees will be applicable every time you extend the loan.

Loan Parameters and Fees

- Minimum loan amount is $100.

- The maximum loan amount depends on the market condition and the collateral used.

- Loan currency: USD, EUR, CHF, GBP, BTC and Stablecoins.

- Loan repayment methods: You can repay the loan using crypto or converting it to fiat, wire transfer, debit/ credit card, or from the account using the close now feature.

Turbocharge

This unique feature offered on Youhodler is designed using the ‘cascade of loans’ principle, a risky phrase. This is akin to the domino effect in a positive way.

Here’s how you can make money from your crypto, where you can use the leverage. It is similar to using the still mortgaged first property, which can be used as collateral for the second property. In the same way, loans can also work. For example, if you deposit collateral that gives you $800, then you can use the amount to get $600, which becomes the capital for the third loan.

YouHodler Alternatives

Youholder BonusMore platforms are offering similar features and services; here is the list:

How Does YouHodler Manage Risks?

YouHodler increased its safety after the data leak issue popped up in 2019, and they have developed 2FA password protection.

The company also has a 3FA security measure for people with more than $10k in their accounts, enabling the investors to turn off all withdrawals.

However, if there is an emergency withdrawal, the company will take additional verification steps to complete the process.

Typically, 3FA needs a pre-authorization for the task, and it can be done using a digital certificate on the machine.

The only risk the platform has is its business model. The way YouHodler makes money may not be enough to run its operations. The platform charges fees from the users on the transactions.

However, the company’s business model is not very clear from the information available online. YouHodler’s competition also mentions that the company uses the loaning amounts to institutional investors, which means the deposited collateral is used as a pledge for another loan by the company on its behalf.

If the company starts sharing more information on this concern, it would be more helpful for the investors to trust the platform.

Conclusion

Youholder BonusYouhodler is a new-age investment and loan platform for crypto lovers, offering unique features other than traditional investment options. However, crypto can be risky; hence, you must consider your risk appetite before using the platform and start small.

Frequently Asked Questions (FAQs)

Is Youhodler reliable?

Yes, Youhodler is a reliable platform as it is an EU and Swiss-based Web3 crypto and fiat fintech company that offers different services such as holding, trading, and crypto rewards.

What are the risks of using YouHodler?

YouHodler is a centralized platform where investors trust a third party for their funds. A risk is involved because the company may use the deposited collateral.

What are the alternatives to YouHodler?

Celsius, Nexo, and BlockFi are some of the alternatives to YouHodler.

Who is the CEO and founder of YouHodler?

Ilya Volkov is the CEO and co- founder of YouHodler. He has over 15 years of experience in Fintech and trading.

What is the meaning of Hodler?

HODL stands for ‘Hold on dear life,’ indicating that crypto investors continue investing in crypto.